By Jim Shimabukuro (assisted by Grok)

Editor

Introduction: I read an article this morning, “The industrialization of solid-state batteries has entered the ‘sprint stage’, and listed companies are vying for a share of the multi-billion-dollar market” (36kr Europe, 11 Oct 2025): “On October 10th, it was reported that Sun Xueliang, a chair professor at Ningbo Dongfang Institute of Technology, collaborated with teams from the University of Western Ontario in Canada, the University of Maryland in the United States, and other institutions to create a new type of halide electrolyte with ultra-high ionic conductivity…. It is understood that this research provides a new technical path for the preparation of ultra-stable all-solid-state batteries and is expected to accelerate the transition of all-solid-state batteries from the laboratory to practical applications.” Intrigued, I asked Grok to look into the general topic of solid-state batteries, and it generated the following report. -js

Why Are Solid-State Batteries So Important?

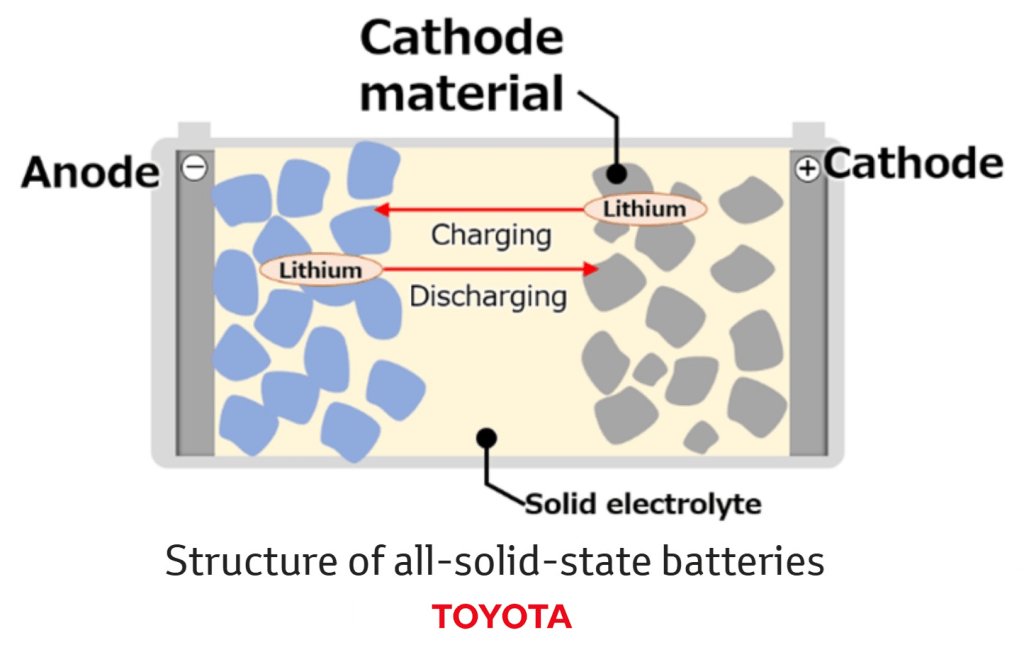

Solid-state batteries represent a major advancement in energy storage technology because they replace the liquid or gel electrolytes in traditional lithium-ion batteries with solid materials (like ceramics or polymers). This shift addresses key limitations of current batteries, making them crucial for accelerating the transition to sustainable energy and electrification. Key advantages include:

- Higher Energy Density: They can store 2–3 times more energy per unit of weight or volume, enabling longer ranges for electric vehicles (EVs) or extended runtime for devices.

- Faster Charging: Capable of recharging in 3–12 minutes (vs. 30–45 minutes for lithium-ion), due to improved ion conductivity and reduced heat buildup.

- Enhanced Safety: Less prone to leaks, overheating, or fires (no flammable liquids), reducing thermal runaway risks by up to 90% in some designs.

- Longer Lifespan and Durability: They resist degradation better, with potential for thousands more charge cycles.

- Environmental Benefits: Smaller size and weight lower material use, and they often use more abundant, less toxic materials, reducing the carbon footprint of production and recycling.

Overall, they’re vital for scaling EVs, renewable energy storage, and portable tech, potentially cutting global emissions by enabling widespread adoption of clean transport and grids.

Who Are the Major Companies in the World?

Several automakers, battery giants, and startups are leading development, with a focus on scaling production for EVs. Here’s a summary of key players based on 2025 progress:

| Company | Headquarters | Key Focus/Progress |

|---|---|---|

| Toyota | Japan | Aiming for world’s first mass-produced all-solid-state EV battery in 2027; prototypes in testing. |

| QuantumScape | USA | Lithium-metal anode tech; partnered with Volkswagen; targeting commercial samples in 2025. |

| Solid Power | USA | Sulfide-based electrolytes; BMW and Ford partnerships; pilot production scaling in 2025. |

| Nissan | Japan | Plans for first solid-state cells in 2025; doubling energy density for EVs. |

| Samsung SDI | South Korea | Mass production targeted for 2027; focus on high-density prototypes. |

| CATL | China | World’s largest battery maker; semi-solid-state in pilots, full solid-state by 2027. |

| BYD | China | Vehicle integration planned for 2027; vertical integration for cost efficiency. |

| ProLogium | Taiwan | World’s first superfluidized inorganic solid-state battery launched in 2025; Mercedes partnership. |

| SK On | South Korea | Accelerated timeline to 2029 commercialization; Hyundai collaboration. |

| LG Chem | South Korea | Broad R&D; focusing on flexible solid electrolytes for wearables and EVs. |

These companies dominate due to investments exceeding $10B collectively, with Asia (Japan, China, Korea) leading ~70% of global R&D.

These Batteries Are Aimed at Which Demographic?

Solid-state batteries aren’t targeted at a narrow demographic like age or income bracket but at market segments driven by performance needs. Primarily, they’re aimed at EV consumers and fleet operators—affluent early adopters (often urban professionals aged 25–55 with household incomes >$100K), who prioritize range, charging speed, and safety in daily commuting or long-distance travel. Secondary targets include:

- Consumer electronics users: Tech-savvy millennials and Gen Z for slimmer, longer-lasting smartphones/laptops.

- Renewable energy adopters: Homeowners and businesses in sunny/windy regions for grid storage.

- Industrial/commercial sectors: Logistics firms and utilities for heavy-duty applications.

The EV focus aligns with growing demand in developed markets (US, Europe, China), where environmental consciousness and tech integration appeal to eco-aware urbanites. Market projections show EVs comprising 60–70% of adoption by 2030.

How Will They Be Used?

Solid-state batteries will primarily power high-demand applications requiring compactness, safety, and efficiency:

- Electric Vehicles (EVs): Core use, extending range to 500–1,000 miles per charge; in cars, trucks, buses, and motorcycles (e.g., Ducati prototypes).

- Consumer Electronics: Slimmer designs for smartphones, wearables, laptops, and drones, with ultra-fast charging.

- Renewable Energy Storage: Grid-scale systems to store solar/wind power, stabilizing intermittent sources.

- Industrial and Aerospace: Heavy machinery, robots, and aircraft for lightweight, durable power.

- Medical Devices: Pacemakers and implants, leveraging biocompatibility and longevity.

Their versatility stems from flexibility in form factors, making them ideal for everything from pocket-sized gadgets to massive energy farms.

When Will They Be Available?

Commercial availability is ramping up, but full mass production varies by company and application:

- 2025: Pilot production and limited rollout (e.g., Nissan’s initial cells, ProLogium’s inorganic batteries in select EVs; semi-solid-state in some Chinese models).

- 2026–2027: Widespread EV integration starts (Toyota’s first vehicles in 2027, BYD installations, Samsung SDI mass production).

- 2028–2030: Broader consumer availability, including electronics and grid storage; costs drop to compete with lithium-ion.

Challenges like scaling manufacturing delay full ubiquity, but 2027 is a pivotal year for premium EVs.

Will They Last Longer?

Yes, solid-state batteries are projected to significantly outlast lithium-ion ones. Lithium-ion batteries typically endure 500–2,000 charge cycles (equivalent to 8–10 years of daily use) before dropping to 80% capacity, due to electrolyte degradation and dendrite formation.

In contrast, solid-state designs offer 2,000–10,000 cycles (15–20+ years), with minimal capacity loss, thanks to stable solid electrolytes that prevent dendrite growth and chemical breakdown. For EVs, this could mean batteries lasting the vehicle’s full lifespan, reducing replacement costs and waste.

Cost a Lot More?

Initially yes, but costs are expected to plummet with scale. As of 2025:

- Current Cost: $400–600 per kWh for solid-state prototypes, vs. $80–100/kWh for advanced lithium-ion—4–6 times more expensive due to complex manufacturing and rare materials.

- Future Outlook: Projected to fall to $150–200/kWh by 2030 (2x lithium-ion) and $80–100/kWh by 2035, matching or undercutting rivals through efficiencies like dry electrode processes and larger factories.

Early adopters (e.g., luxury EVs) will pay a premium (~10–20% higher vehicle cost), but long-term savings from longevity and efficiency will offset this for most users.

Filed under: Uncategorized |

Leave a comment